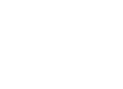

The Steps of Your Journey

Our Process

First Meeting

You call and we arrange a time to meet that is convenient for you. At that appointment, I introduce myself and we start to build a picture of who you are, what you want and how we are going to achieve your goals, dreams and aspirations by getting to know you and having a detailed picture of where you want to be.

Understanding Goals

By the end of the appointment, I should be able to give you a picture of how I can help you to achieve those dreams and if it can be done. Sometimes it may take more than one appointment should it be necessary to obtain more detailed information, but usually I can give you an idea of how we are going to meet your hopes and dreams after the first hour to hour and a half by specialising in how we are going to meet those dreams.

Engagement

From there you decide whether you like what you hear and whether you would like to proceed to the next step of me providing a detailed financial plan which includes Centrelink should it be available to you. Anything you sign you get a copy of so that you are fully aware and confident of what plan fee you have agreed to and there are no surprises. There is no payment payable until after I present your financial plan (Statement of Advice).

Second Meeting

Then within 2-3 weeks I call you to arrange a second appointment to present your detailed financial plan (Statement of Advice) which is yours to keep and should you wish to implement your financial plan there is an implementation fee which is agreed with you at the initial appointment.

Statement Of Advice

I sit down with you at that appointment and present your Financial Plan (Statement of Advice) in a detailed document of how we are going to achieve those dreams and aspirations in writing. The financial plan also sets out what our ongoing obligations are to you and what we would like from you.

Implementation

Should you also be entitled to Centrelink as per the financial plan ie Low Income Health Care Card, Pensioner Concessioner Card, Age Pension etc we take care of all the paperwork and become your nominee so that there is no need to have to wrestle with Centrelink again after the initial application and we take care of the implementation of your financial plan so that you can get on with doing what you want to do.

Ongoing Review Service

A financial plan requires regular review in order to ensure that it continues to meet your needs. The review process should address:

- Your changing needs and objectives

- The economic environment

- Investment sector performance

- Your taxation position

- Social security issues

- Investments available

- Taxation position of investments

- Fund manager and investment performance

- Your income and debt levels

- Your family situation and health

Recommended Review Service

Annual Review Meeting:

A major annual review to address the following (where appropriate):

- Review your statement of assets and liabilities

- Assess your income and tax position

- Set goals and objectives, including short-term aims and long-term objectives such as holidays, schooling and retirement planning ie achieve your dreams

- Analyse investment portfolio, including:

- Valuation and performance reports

- Benchmark performance analysis

- Asset allocation and risk profile analysis

- Fund manager rating changes

- Investment opportunities (gearing; savings plans; tax effective investment alternatives)

- Revise portfolio projections, including superannuation forecasts and

retirement viability projections

Estate planning overview

You can also expect to receive the following additional services from us:

- Invitations to client seminars throughout the year. Seminars will cover an array of topics including economic briefings, market analysis, fund manager speakers, and non-financial planning briefings

- Regular newsletters on financial planning and investment issues

- Adviser access by phone, email, and in person for immediate one off issues

- Provision of share market reports, investment articles, and other items of interest

- Family Financial Planning service designed for the immediate dependents of clients at no charge